As a leading provider in the field of Know Your Customer, we recognise the paramount importance of efficient KYC processes in today's dynamic business landscape. Our KYC solutions are meticulously crafted to cater to diverse industries, offering a comprehensive suite of tools to streamline customer onboarding while ensuring strict adherence to regulatory guidelines. From swift identity verification and document authentication to diligent risk assessment, our state-of-the-art platform integrates advanced AI and machine learning algorithms to fortify your defence against fraudulent activities. Whether you're a burgeoning startup or an established enterprise, our KYC solutions are adept at scaling to your specific requirements, bolstering security measures while expediting operations. Join us in embracing a future where KYC processes transcend the mundane and witness firsthand how our innovative solutions can elevate your business in an increasingly complex digital world.

Our KYC solutions redefine identity verification by seamlessly blending cutting-edge technology with regulatory compliance. With our platform, businesses across industries can efficiently verify customer identities, expediting onboarding while adhering to stringent rules. Our AI-powered algorithms cross-reference provided information against extensive databases, ensuring accuracy and security. Through this, we create a frictionless yet secure environment, streamlining the user experience and bolstering fraud prevention.

Say farewell to manual document checks with our document verification services. We use advanced optical character recognition (OCR) and pattern recognition technologies to authenticate documents swiftly and accurately. Our platform prevents the use of forged or doctored papers and reduces the risk of human error. This empowers businesses to onboard customers confidently, meet compliance standards, and deter fraudulent activities.

Incorporate an essential layer of security into your KYC processes with our watchlist screening services. Our platform scans an extensive range of global watchlists and databases in real time to identify individuals or entities associated with criminal or suspicious activities. Automated alerts ensure potential risks are flagged, allowing businesses to take immediate action and maintain regulatory compliance. By integrating watchlist screening, you can safeguard your operations against potential threats while building a trustworthy customer base.

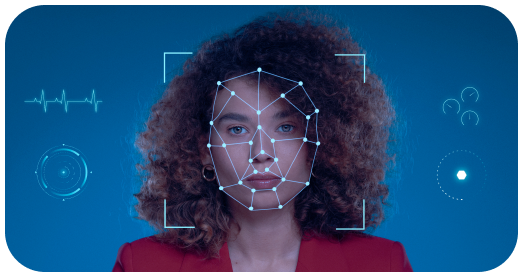

Experience a new era of secure verification with our biometric authentication services. Our platform ensures foolproof identification by utilizing unique biological traits like fingerprints, facial features, or voice patterns. Biometric data is nearly impossible to replicate, providing robust protection against unauthorised access and fraud. This technology enhances security and streamlines customer experience by reducing the need for remembering complex passwords or PINs. Trust in a verification method that's as unique as your customers with our biometric authentication solutions.

Navigate the intricacies of compliance confidently with our enhanced due diligence solutions. Tailored for businesses dealing with higher risk factors, our platform combines advanced analytics and extensive data sources to provide comprehensive insights into the background of individuals and entities. You can make informed decisions about potential associations, financial histories, and reputations by conducting thorough investigations. This heightened scrutiny ensures that your business maintains its integrity despite complex regulatory landscapes while protecting against undue risks.

Stay ahead of potential risks with our risk scoring and monitoring tools. Our AI-driven algorithms analyze customer behaviour, transaction patterns, and various data points to assign risk scores dynamically. This proactive approach empowers businesses to identify unusual activities in real time and take swift actions to mitigate potential threats. By constantly monitoring customer activities against evolving regulatory standards, you can uphold compliance while detecting anomalies that might indicate fraudulent behaviour. Trust in our risk scoring and monitoring solutions to safeguard your business's reputation and security effectively.

Start your journey with us today and allow us to take you to the next step of your path to greatness.